Wing Fai Ng’s projected net worth, which ranges from $8 million to $10.5 million in 2025, shows how equity-driven strategies can be incredibly successful when carried out carefully and strategically. His career path, which was influenced by senior positions at AGBA Group and Convoy Global, is remarkably similar to that of many Hong Kong executives who have switched from traditional finance to digital-first businesses. His wealth, in contrast to that of the city’s billionaire titans, is measured by well-considered investments in businesses that are navigating the fintech and media industries of the future rather than by expansive real estate empires or shipping dynasties.

With over 7.3 million shares of Triller Group Inc. and a sizeable ownership stake in AGBA, a large portion of his wealth is rooted in insider holdings. Despite its volatility, this focus on equity has been especially helpful in establishing Ng as a significant voice in discussions regarding media disruption. Positioned as a competitor to TikTok, the AGBA–Triller partnership represents a daring step that brings Hong Kong’s capital into line with current cultural consumption patterns. When compared to global trends, this shift is particularly evident, as financiers now see digital media as both entertainment and a means of future expansion.

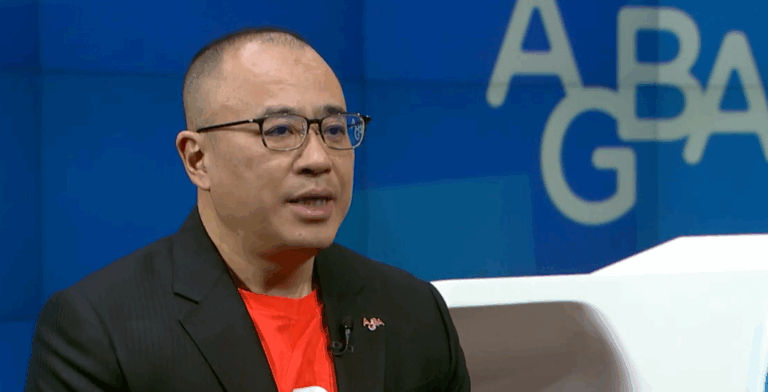

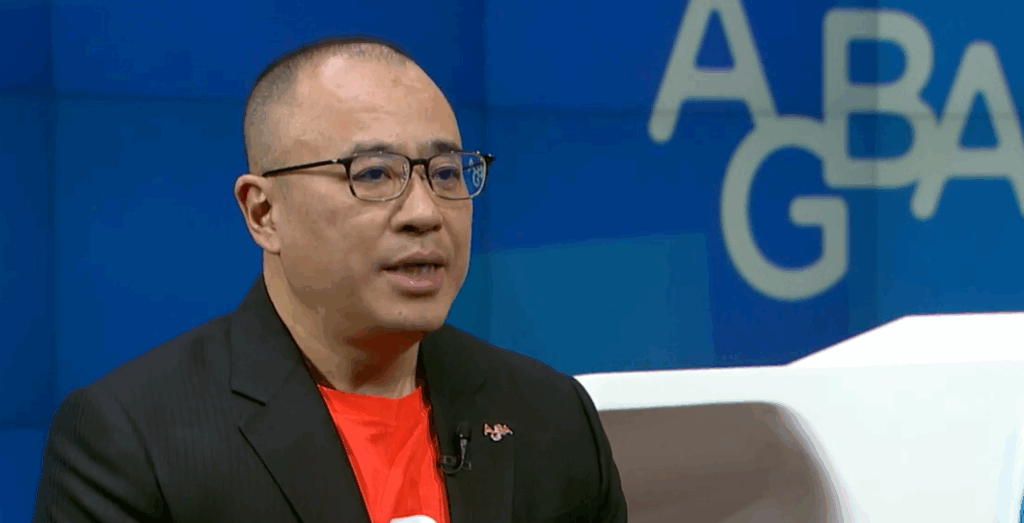

Wing Fai Ng – Bio Data & Professional Information

| Category | Details |

|---|---|

| Full Name | Wing Fai Ng |

| Nationality | Hong Kong |

| Profession | Business Executive, Investor |

| Current Roles | Group President, AGBA Group Holding Ltd; President, Convoy Global |

| Net Worth (2025) | Between $8 million and $10.5 million (based on equity holdings) |

| Key Assets | 7.3 million shares of Triller Group Inc (ILLR), shares in AGBA Group |

| Industry | Finance, Consumer Services, Digital Media |

| Notable Involvement | AGBA/Triller partnership to rival TikTok in social media |

| Age | 57 years |

| Reference | Quiver Quantitative – Wing Fai Ng Profile |

His approach, which emphasizes accumulation over dispersion, has proven to be very effective. According to SEC filings, 2024 was his busiest year, spending over $2.7 million to buy over five million shares, which significantly increased his stake in growth potential. U.S. insiders like Peter Thiel, whose concentrated bets on early ventures ultimately translated into exponential returns, are reminiscent of this aggressive equity accumulation. Ng is not yet a billionaire, but his actions show how perseverance and faith in the stock market can turn small positions into long-lasting impact.

Wing Fai Ng’s subtle approach is what sets him apart. In contrast to individuals like Jan Koum, who invested billions in estates and yachts, Ng is still characterized by his strategic shareholding and boardroom positions. In Hong Kong’s business environment, where obscure executives frequently hold subtle yet significant power, this discretion is incredibly dependable. In this way, his impact is remarkably comparable to that of mid-tier financiers in New York and London who, despite being less well-known than billionaires, significantly influence industries through partnerships, mergers, and deals.

His business endeavors’ societal impact stems from AGBA’s dual emphasis on digital media and finance. AGBA demonstrates a particularly creative approach by utilizing financial services knowledge and connecting it to consumer-driven entertainment platforms—combining formerly disparate industries. This approach has made it possible to expand into consumer attention markets and has greatly decreased dependency on legacy revenue streams. The strategic thinking seems very adaptable, mirroring how companies such as Tencent integrate media, gaming, and payments into ecosystems that control day-to-day activities.

His tale also emphasizes how important transparency is becoming to financial leadership. In contrast to magnates whose fortunes are hidden by offshore holdings, Wing Fai Ng’s net worth is remarkably transparent because a large portion of it is linked to publicly disclosed ownership stakes. Despite putting him under scrutiny, his prominence gives investors more confidence when navigating the erratic stock markets. In Hong Kong, where calls for accountability have only gotten louder in recent years, this dynamic has significantly improved the perception of governance.

Wing Fai Ng’s age of 57 places him in a unique position to serve as a link between two generations of businesspeople: those who established conventional financial institutions and those who are pioneering digital-first businesses. He can appeal to both younger audiences drawn to platforms like Triller and older investors looking for dependability thanks to this dual grounding. His job is not to dominate Forbes lists, but to strategically lead organizations that have the potential to dramatically increase Asia’s competitiveness in the global media landscape in the years to come.

Ng’s wealth might seem modest when compared to Hong Kong’s billionaires, such as Li Ka-shing or Lui Chee Woo. The contrast, however, is instructive. Tycoons grew their businesses through real estate, ports, or casinos, but Ng works in the delicate area where media and finance meet. It serves as a reminder that influence can exist in strategically positioned shares that have the power to completely transform industries; it is not always necessary to have billions. His story is especially useful for comprehending how executives who are not billionaires nevertheless have a significant influence on the course of their companies.

More general changes in society are also reflected in the AGBA–Triller story. With platforms like TikTok influencing politics, culture, and consumer behavior, digital consumption patterns have emerged as crucial indicators of influence in recent years. By portraying AGBA as a rival, Ng is indirectly funding not only a business but also the global information flow. The action is incredibly successful in bringing financial capital and cultural momentum into alignment, which is a trend observed all over the world as financiers try to dominate not only markets but also people’s attention spans.